Competitive SEO Analysis: How to Steal An Audience and Dominate the US / UK Markets

Why Your Biggest SEO Competitors Are Hiding in Plain Sight

Right now, while you’re reading this, potential customers are searching for your products and services online. And in most cases, they’re finding your competitors instead of you.

The problem is that businesses often focus on well-known competitors, overlooking those actually attracting their target audience online. They analyze companies they recognize from industry events or trade publications, while the websites actually capturing their customers remain invisible to them.

The competitive blind spot: In mature markets like the US and UK, the companies dominating search results for your most valuable keywords often operate with completely different strategies than traditional industry players.

Here’s what we consistently observe when auditing competitive landscapes:

- Most businesses we analyze are competing against websites they’ve never heard of

- The top-ranking content for commercial keywords often comes from unexpected sources

- Market leaders offline frequently rank on page 3–4 for their own core services

- Specialized content sites consistently outrank established brands for high-intent searches

This disconnect creates significant opportunities for businesses that understand how to identify and analyze their real search competitors. The key is knowing where to look and what signals matter most.

Finding Your Real SEO Competitors

The first critical step is identifying who’s actually competing for your audience in search results. This isn’t about industry positioning — it’s about search visibility.

Build Your Money Keyword Arsenal

Commercial Intent Keywords:

- “buy [product category] online”

- “[service type] pricing”

- “best [product] deals 2025”

- “[competitor] alternative”

- “order [service] today”

Local and Near-Me Intent Keywords:

- “[service] near me”

- “[product] [city name]”

- “local [service provider]”

- “[service] in [area]”

- “[city] [service] reviews”

Informational Keywords with Commercial Potential:

- “how to choose [product category]”

- “[solution A] vs [solution B] comparison”

- “why [product type] expensive”

- “[specific problem] solution guide”

- “best [product] for [specific need]”

Brand-Adjacent Keywords:

- “[competitor brand] reviews”

- “[competitor brand] problems”

- “cheaper than [competitor brand]”

- “[competitor brand] vs alternatives”

SERP Analysis for Competitor Identification

Now comes the detective work. Search every money keyword and document who owns the real estate.

Track these SERP features systematically:

- Featured snippets

- Local pack results

- Knowledge panels

- Image and video results

- Shopping results

- “People also ask” sections

Create your threat matrix: Count how often each domain appears in top-10 results across your keyword set.

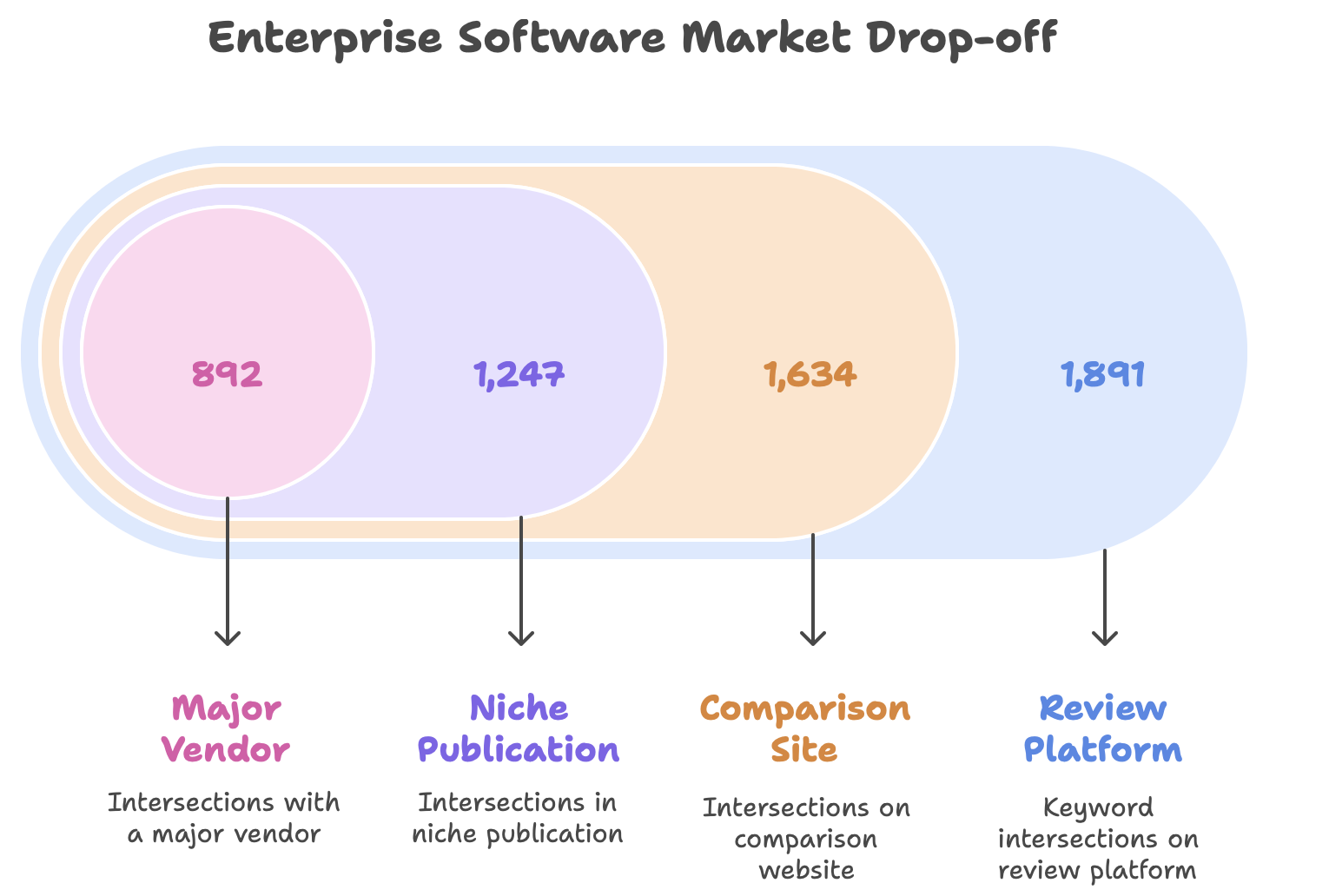

Enterprise Software Market Example:

- Industry review platform: 1,891 keyword intersections

- Specialized comparison site: 1,634 intersections

- Niche industry publication: 1,247 intersections

- Major enterprise vendor: 892 intersections

So, the unknown review platform poses twice the search threat of the major enterprise vendor. While business intuition suggests the large vendor is the primary competitor, the specialized review platform actually captures twice as much overlapping search traffic.

Deep Competitor Analysis

Once you know who’s actually stealing your traffic, it’s time to figure out how they’re doing it.

Comprehensive Keyword Analysis

Export their keyword core and compare it to yours:

Coverage gaps: What keywords are they ranking for that you’ve never even considered? Often these reveal entire market segments you’re missing.

Opportunity zones: Terms where they rank positions 5–10 (easier targets than position 1–2 battles).

Content themes: Topic clusters they’ve built that you haven’t — this reveals their content strategy.

Long-tail opportunities: Specific variations they target that you completely miss.

Traffic Source Investigation

Prepare to have your assumptions challenged. Here’s where competitors actually get their organic traffic:

Professional Services Firm:

- Educational blog content: 64%

- Service description pages: 18%

- Case study sections: 12%

- Homepage and company pages: 6%

E-commerce Platform:

- How-to guides and tutorials: 71%

- Individual product pages: 8%

- Category navigation pages: 16%

- Brand and company information: 5%

Important note: Results vary significantly by industry, but analyzing your competitors’ most popular pages often reveals surprising insights about what actually drives their traffic.

Content Strategy Analysis

What format are they using to dominate?

- Long-form comprehensive guides vs. quick articles

- Video integration and multimedia elements

- Interactive tools and calculators

- Downloadable resources and templates

Content quality assessment:

- Writing depth and expertise demonstration

- Visual elements and custom graphics

- User engagement signals (comments, shares, time on page)

- Content freshness and update frequency

Content gap opportunities:

- Missing topics they don’t cover (your opportunity)

- Shallow coverage you can dominate with depth

- Outdated content you can refresh and outrank

Technical Performance Analysis

Technical tracking will help you identify opportunities to outrank competitors through superior site performance.

The competitive advantage: Technical excellence isn’t glamorous, but it’s often the deciding factor between page 1 and page 2 rankings.

The Three-Stage Traffic Domination Plan

Stage 1: Quick Strike

Target the accessible opportunities:

- Keywords where competitors rank positions 5–10 (easier to beat than position 1)

- Outdated content you can refresh with current data

- Technical gaps you can fix faster than they can respond

- Optimize for SERP features they’re missing

Stage 2: Authority Building

Content development tactics:

- Create the most comprehensive resources on target topics

- Add multimedia elements competitors ignore

- Include expert perspectives and original research

- Establish content update schedules that keep you ahead

Stage 3: Market Leadership

Build competitive advantages:

- Develop unique resources competitors can’t easily replicate

- Create expert networks and industry relationships

- Build proprietary tools and calculators

- Establish thought leadership through consistent innovation

The Professional Arsenal: Tools That Reveal Secrets

Ahrefs Site Explorer: The gold standard for organic traffic analysis and keyword gap identification. Shows you exactly where competitors get their traffic.

SEMrush Organic Research: Particularly powerful for US market analysis with detailed SERP feature tracking.

SpyFu: Specializes in competitive keyword research and shows historical performance trends.

Screaming Frog SEO Spider: Technical deep-dive tool that uncovers site architecture weaknesses competitors don’t know they have.

Manual SERP Analysis: Never rely solely on tools. The human eye catches opportunities automation misses.

From Intelligence to Market Domination

Here’s the reality about competitive SEO: most businesses spend months analyzing and never start executing. They study their competitors extensively while those same competitors continue capturing more customers.

The companies winning this competition:

- Identify real search competitors within days, not months

- Act on opportunities while competitors are still planning

- Create superior content consistently, not occasionally

- Build sustainable advantages through systematic execution

The companies losing market share:

- Analyze industry competitors instead of search competitors

- Create similar content instead of superior alternatives

- React slowly to competitive threats

- Focus on perfect plans instead of rapid execution

Your competitive advantage exists in the gap between analysis and action. While your competitors attend conferences and read industry reports, search-dominant companies capture customers actively searching for solutions right now.